PennyMac Mortgage Investment Trust (PMT)·Q4 2025 Earnings Summary

PennyMac Mortgage Investment Trust Posts Strong Q4 with 13% ROE, Stock Rises After-Hours

January 29, 2026 · by Fintool AI Agent

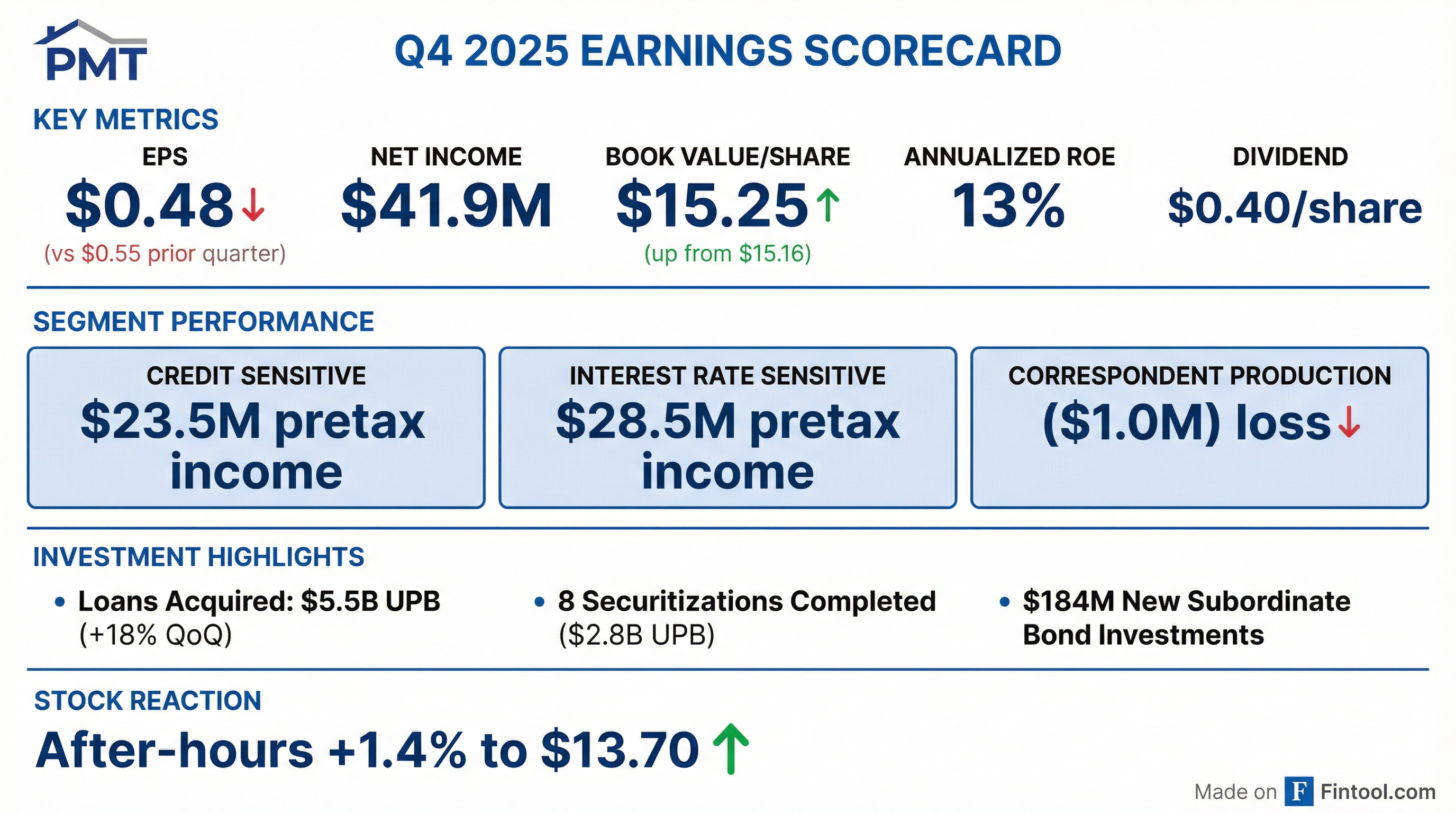

PennyMac Mortgage Investment Trust (NYSE: PMT) delivered a strong fourth quarter, reporting net income attributable to common shareholders of $41.9 million, or $0.48 per diluted share . The mortgage REIT achieved a 13% annualized return on average common equity, meaningfully above its dividend level, driven by solid contributions from credit sensitive and interest rate sensitive strategies plus a tax benefit . Shares rose approximately 1.4% in after-hours trading to $13.70.

Did PennyMac Beat Earnings?

PMT exceeded expectations with EPS of $0.48, approximately 27% above consensus estimates of around $0.38. The beat was driven by:

The quarter included a $16.2 million tax benefit driven primarily by net fair value declines on MSR and interest rate hedges held in the taxable REIT subsidiary .

How Did Each Segment Perform?

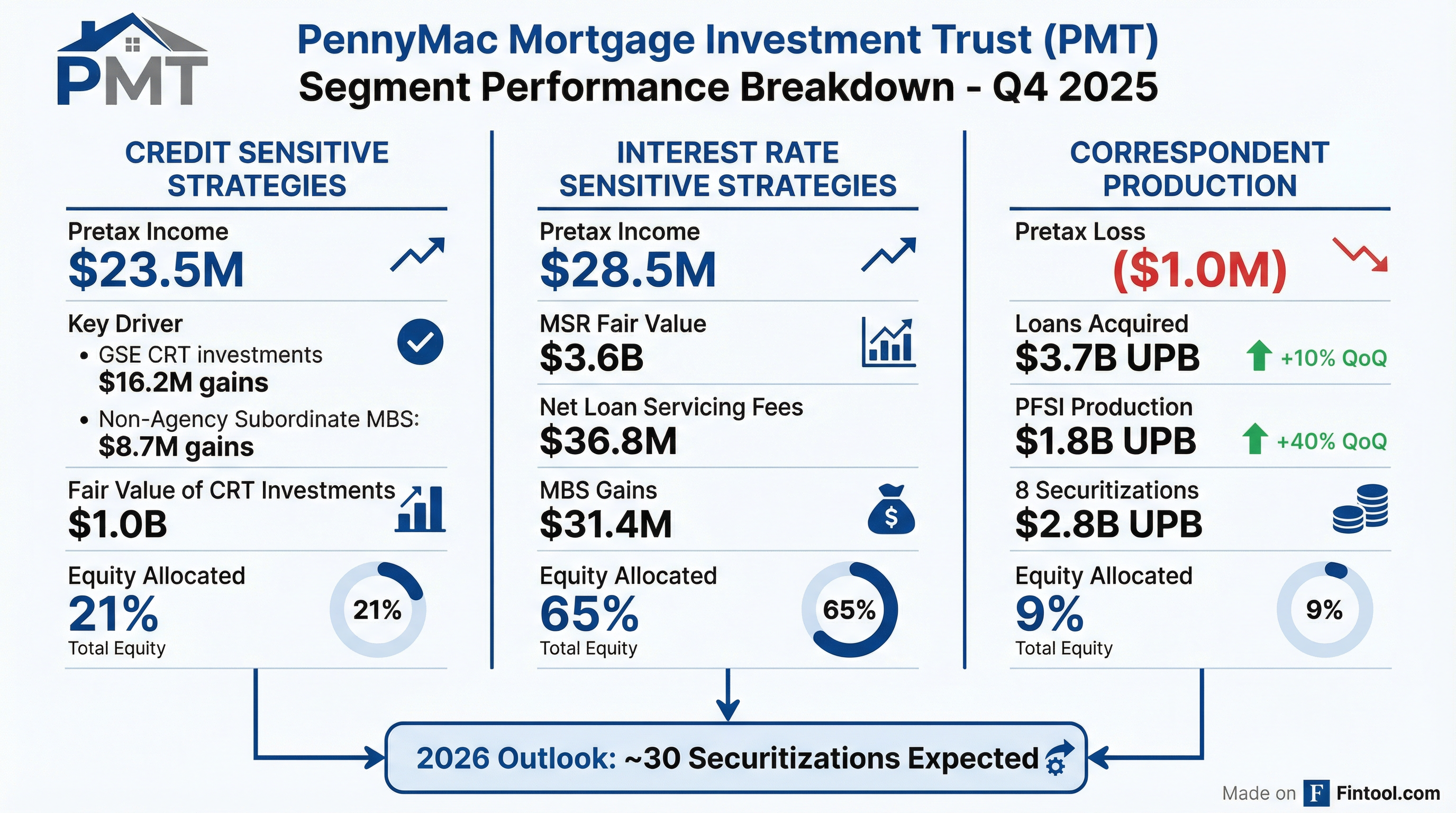

Credit Sensitive Strategies: $23.5M Pretax Income

The credit sensitive segment delivered $23.5 million pretax income on $23.6 million net investment income, up from $18.8 million in Q3 .

- GSE CRT gains: $16.2 million vs. $13.7 million prior quarter, including $3.6 million from credit spread tightening

- Non-Agency subordinate MBS gains: $8.7 million from private label securitization investments

- Fair value of CRT investments: $1.0 billion with 46% weighted average current LTV

Interest Rate Sensitive Strategies: $28.5M Pretax Income

Pretax income of $28.5 million on $52.7 million net investment income, down from $32.3 million in Q3 .

- MSR fair value: $3.6 billion at quarter end

- Net loan servicing fees: $36.8 million vs. $15.4 million prior quarter

- MBS gains: $28.2 million primarily from Agency securities

- Hedging losses: $(45.0) million to manage interest rate exposure

Correspondent Production: $(1.0)M Pretax Loss

The production segment swung to a $1.0 million loss from $9.2 million profit in Q3 .

- Loans acquired: $3.7 billion UPB (+10% QoQ) through fulfillment agreement

- PFSI production acquired: $1.8 billion UPB (+40% QoQ) for private label securitizations

- Loss drivers: Spread widening on jumbo loans during aggregation and lower channel margins

What's Driving PMT's Investment Strategy Shift?

PMT accelerated its strategic pivot toward private label securitizations in 2025:

Q4 2025 alone: Eight securitizations completed ($2.8 billion UPB), generating $184 million in net new subordinate bond investments .

CEO David Spector emphasized the strategic importance: "PMT delivered strong results in the fourth quarter, generating earnings per share of $0.48, above the dividend level for an annualized return on common equity of 13%... We took significant steps to build future earnings potential, accelerating our organic investment activity with the execution of eight private label securitizations totaling $2.8 billion in UPB."

How Did the Stock React?

PMT shares closed at $13.51 on January 29, 2026, then rose approximately 1.4% to $13.70 in after-hours trading following the earnings release.

The stock trades at a 11.5% discount to book value ($15.25), reflecting broader mortgage REIT sector dynamics.

What Did Management Guide?

Management provided a run-rate earnings framework projecting the following annualized returns by strategy :

2026 Outlook: PMT expects to complete approximately 30 securitizations in 2026, with targeted returns on equity for retained investments in the low-to-mid teens .

Average Diluted EPS Per Quarter: Management projects approximately $0.40 based on current strategies and market conditions .

What Changed From Last Quarter?

Improving:

- Book value per share increased $0.09 to $15.25

- Loan acquisition volumes up 18% QoQ to $5.5 billion UPB

- Net loan servicing fees surged to $36.8 million from $15.4 million

- Raised $150 million through exchangeable senior notes

Declining:

- Net investment income down 5.7% to $93.6 million

- Correspondent production swung to a loss

- MSR fair value down slightly to $3.6 billion

What Are the Key Risks?

Balance Sheet Leverage: Total debt-to-equity increased to 10.1:1 as PMT consolidates private label securitization assets on its balance sheet. However, excluding non-recourse debt (where repayment is limited to collateralized loans), leverage is 6.0:1, in line with historical levels .

Interest Rate Sensitivity: The company actively hedges MSR and MBS positions, but hedging losses of $45 million this quarter demonstrate ongoing exposure .

Correspondent Margin Pressure: Lower channel margins and spread widening on jumbo loans pressured production economics .

Delinquency Trends: Overall delinquency rates increased slightly, with servicing advances rising to $97 million from $63 million, primarily due to seasonal property tax payments .

What Did Analysts Ask About?

The Q&A session revealed key investor concerns and management perspectives:

Competition in Non-Agency Space

CEO David Spector addressed the competitive landscape: "On the jumbo side, we're seeing very healthy activity from the likes of Rocket Mortgage on the retail side and UWM on the broker side... we don't see a lot of bank competition. Redwood Trust is active in the jumbo market from time to time."

MSR Portfolio Flexibility

When asked if PMT would consider selling MSRs, Spector confirmed openness: "We would consider it. As we find ourselves in a position where we can see higher returning assets versus MSRs, of course, we would look at it."

Risk Management Enhancements

Management highlighted a new Q4 financing facility: "In Q4, we implemented a facility that doesn't have a mark-to-market feature, and that's very important from a risk management standpoint." This mirrors protections PMT had during COVID .

January Market Conditions

CFO Dan Perotti noted continued strength: "In the non-agency space, spreads have been stable to tightening in sympathy with agency spreads. We've continued to see fairly robust demand for securitizations in January." PMT completed three securitizations in January across non-owner occupied, jumbo, and agency-eligible owner-occupied collateral types .

Industry Capacity for Refi Surge

On potential affordability-driven programs: "There's actually more excess capacity in the sector than I thought there would be... I think we as an industry are in pretty good shape for a $2.4-$2.5 trillion market. Much beyond that, we would require bringing on more capacity."

Equity Allocation Trajectory

Non-agency securitization allocation is expected to grow: "We have it at 9% as an average through the next few months. As we get to the end of the year, it's a few percentage points higher than that... probably 11 or 12% by the end of the year."

Full-Year 2025 Results

The year-over-year decline reflects challenging mortgage market conditions in early 2025, though PMT maintained its dividend and accelerated its securitization strategy to build future earnings power.

This analysis was generated by Fintool AI Agent based on PMT's Q4 2025 8-K filing, earnings call transcript, and earnings materials released January 29, 2026.

Related Links: